As a business owner, you may have numerous assets held through your business: cars, trucks, computers, equipment, and maybe even real estate. But have you ever wondered if your business can “own” a boat? As we’ll show, you can actually buy a boat through your business, even if it has little or nothing to do with boating. As long as you can demonstrate a legitimate purpose for the boat, you can buy it and enjoy the tax benefits of this purchase.

Note: Scout Boats is not a tax or financial expert. This article is for general information only and should not be taken as financial advice. Always speak with an expert before making a decision.

A Boat Can Be a Business Expense

To legitimately buy a boat through your business, you need to have a specific reason for purchasing it as a business expense. For some, the reason is obvious: commercial and recreational fishing companies have a clear and easily-defined reason for needing a boat. But what about a typical company such as a marketing firm, accounting office, or manufacturing business? In this case, the reason is less obvious, but it still exists.

Entertainment is usually the motivation for buying a boat through your business, but the IRS has some tricky rules behind this use. In general, the IRS says you cannot deduct any expense for the use of entertainment, but you can deduct some expenses. So while you can use company money to purchase a boat (as long as the boat is used primarily business purposes), you will likely not be able to write off the purchase as a tax deduction.

However, you may be able to deduct other expenses related to the use of the boat. Food, beverages, and catering can likely be deducted. Even fishing bait or lures that were purchased for and used during entertainment of clients or employees could be considered a tax deduction. Just remember to document these expenses thoroughly.

For entertaining employees, you will also need to show that the use of your boat has a legitimate business purpose. Week-long fishing expeditions for the primary owner may not be a legitimate reason, but team-building exercises could be. The boat could even be used for enticing new employees, but again, proper documentation is crucial.

Above all, if you buy a boat for business use, it will have to primarily remain a business asset. You can’t use it for personal luxury cruises all summer, then take an employee fishing once a year and claim it as a business asset. Be honest about how you use the boat or you may come under scrutiny from the IRS.

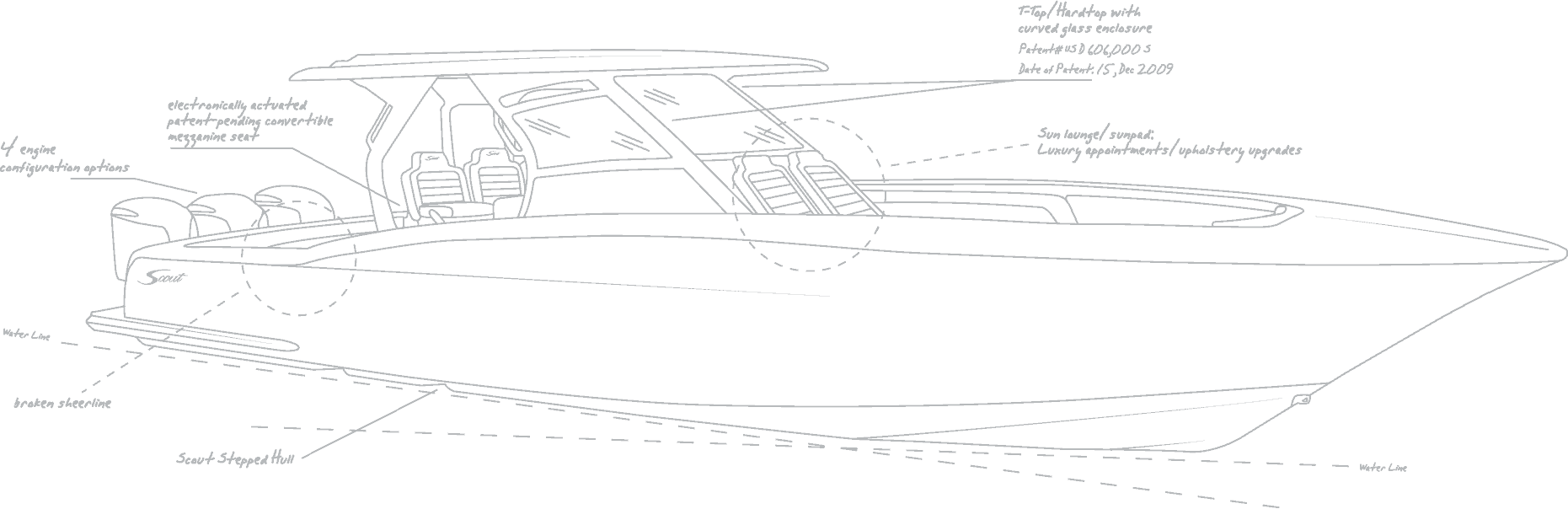

Scout Boats: The Right Luxury Vessel For You

Now that you know you can buy a boat through your business, our Scout luxury fishing boats are the perfect choice for entertaining clients and employees. With comfort and convenience, one of our outstanding boats could be the most popular asset in your business!

Contact us today for more information on purchasing a Scout.